Online trading platforms have revolutionized the way individuals engage in financial markets, allowing them to trade a wide range of assets including stocks, Forex, commodities, and cryptocurrencies from the comfort of their homes. These platforms serve as intermediaries, connecting traders to financial markets through a user-friendly interface that often includes real-time data, charts, and technical analysis tools. Checkout: Binarycent

Features of Online Trading Platforms

Accessibility: Modern trading platforms are designed to be accessible to both experienced traders and beginners. Many platforms offer mobile apps, ensuring traders can monitor their investments and make transactions anytime, anywhere.

Asset Variety: Most platforms provide access to multiple asset classes. For instance, you can trade Forex, stocks, binary options, cryptocurrencies, or commodities, giving users a diversified portfolio.

Low Fees and Commissions: Compared to traditional brokers, online platforms typically have lower fees, with many platforms offering commission-free trading. This appeals to new traders who are looking to start without incurring large transaction costs.

Leverage: Many platforms offer leverage, allowing traders to open positions larger than their account balance. While leverage can amplify profits, it also increases risk, making it essential for traders to understand the implications before using it.

Educational Resources: Most platforms provide resources to educate traders, such as tutorials, webinars, and demo accounts, where users can practice trading without risking real money. This is particularly useful for beginners trying to get a feel for the markets.

Popular Online Trading Platforms

Several well-known platforms dominate the market:

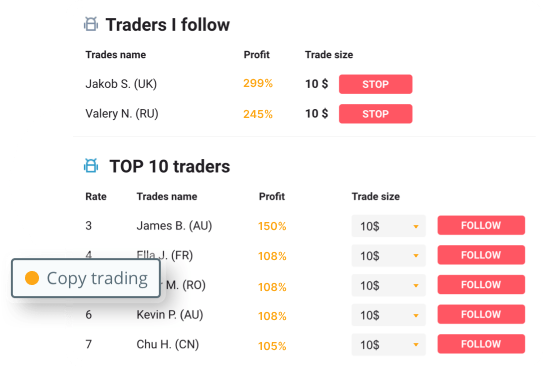

eToro: A popular platform for copy trading, eToro allows users to follow and mimic the trades of experienced investors. It offers various asset types including stocks, copyright, and commodities.

MetaTrader 4 and 5 (MT4/MT5): Favored by Forex and CFD traders, these platforms provide advanced charting tools and algorithmic trading capabilities.

Robinhood: Known for its commission-free trading model, Robinhood has grown in popularity, especially among retail investors. The platform focuses on stocks and copyright but has faced criticism for outages during peak trading times.

copyright: One of the largest copyright exchanges, copyright provides a comprehensive suite for trading copyright assets, with both beginner-friendly and advanced features.

Pros and Cons

Advantages:

Real-Time Trading: With live market data and fast execution speeds, traders can react to market movements instantly.

Diverse Investment Options: Users can trade in different markets from one platform, diversifying their investments.

Lower Costs: Fees and commissions tend to be lower than traditional brokers, making online platforms more attractive for regular traders.

Disadvantages:

Risk of Overtrading: Easy access to markets can tempt users to make impulsive trades without thorough research, leading to potential losses.

Security Concerns: Cybersecurity is a growing issue, especially for copyright platforms, where large hacks have occurred in the past.Visit here: Binarycent

Final Thoughts

Online trading platforms have democratized access to financial markets, making trading easier and more accessible for retail investors. However, with convenience comes responsibility, and traders should always ensure they are using secure platforms, understand the risks involved, and use tools such as demo accounts to practice before committing real money. As technology advances, the options and features available on these platforms continue to expand, offering even more opportunities to participate in global financial markets.